AS: How not to get a mortgage

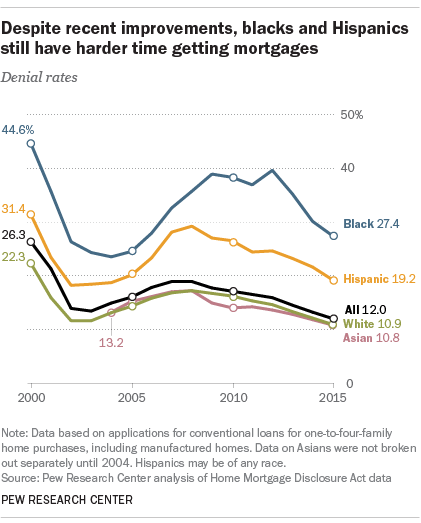

However, in the United States, those same numbers somehow look different to potential lenders based upon the applicant’s race.

As PBS's Marketplace explains, that’s a persistent problem. Race plays a significant factor in whether someone gets a mortgage, and on what terms—regardless of the applicant’s credit rating.

There’s quite a bit of data, compiled by various methods, that reinforce this conclusion. ABC and its affiliates have reported on the disparate experience of white people and people of color trying to obtain mortgages.

The researchers of the online lending marketplace LendingTree have found that Black applicants are rejected at a much higher rate than white applicants, varying by metropolitan area.

We might think that this shouldn’t happen—isn’t mortgage approval calculated by computers? They’re colorblind, right?

But computer algorithms can also exhibit bias. This can happen for several reasons. They are written by humans, who may not realize that the assumptions they include are biased. Also, the underlying data may be tainted. For example, a homeowner in a primarily Black neighborhood will appear to have a lower asset value than someone owning a similar house in a primarily white neighborhood, and that might affect whether they are approved for a mortgage when hoping to move to a new home.

Investigative journalists Emmanuel Martinez and Lauren Kirchner of the journalistic organization The Markup found significant bias in the computer algorithms used to determine whether to approve mortgages; go to its site for interactives. Despite the protestations of lenders, and lenders' resistance, Martinez and Kirchner did not mince words:

To see how denial of mortgages because of race plays out in a major metropolitan area, check out Racial Disparities in Mortgage Lending in Los Angeles, by Mousa Toure, Juan Higareda, and Lupe Salome.When we examined the decisions by individual lenders, many denied people of color more than White applicants. An additional statistical analysis showed that several were at least 100 percent more likely to deny people of color than similar White borrowers. Among them: the mortgage companies owned by the nation’s three largest home builders.

As they have found, the percentage of mortgage denials varies significantly by race in the City of Los Angeles, in Los Angeles County, and in California.

And if you really want to explore some of the details, you can look at mortgage denial rates by race and neighborhood.